Kornit Digital Sees ‘Promising Indicators’ Emerge As It Reports Its First Quarter 2023 Results

Image By Courtesy of Kornit Digital

Thursday, May 11, 2023

First quarter revenues of $47.8 million, in line with prior guidance

First quarter GAAP net loss of $18.9 million; non-GAAP net loss of $13.4 million

MAX upgrades drive strong quarter for Services

Double-digit year-over-year impressions growth from several strategic customers

New Atlas MAX Poly and Direct-to-Fabric customers added in key textile regions

Set to showcase new break-through solutions at June ITMA tradeshow in Milan, Italy

ROSH-HA`AYIN, Israel -- Kornit Digital Ltd. (“Kornit” or “the Company”), a worldwide market leader in sustainable, on-demand, digital fashionX and textile production technologies, reported today its results for the first quarter ended March 31, 2023.

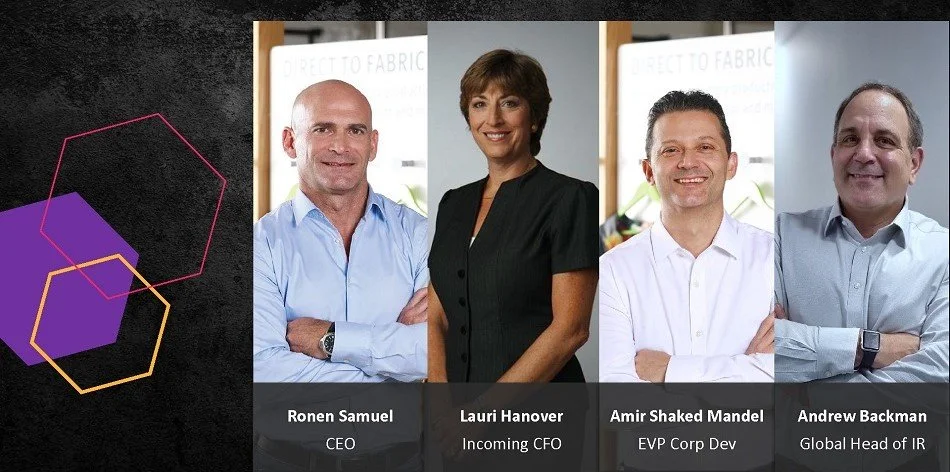

“Promising indicators emerged during the first quarter in certain parts of our business, despite the persistent macroeconomic pressures,” said Ronen Samuel, Kornit’s Chief Executive Officer. “These indicators included the double-digit year-over-year impressions growth from several of our larger direct-to-garment (DTG) strategic accounts in the customized design market, and the continued adoption of our MAX technology. While capacity utilization is still not optimal, we see immense opportunities unfolding with major demand generating platforms and expect this market to resume growth as overall macro conditions improve.”

Mr. Samuel continued, “With our MAX technology as the cornerstone, we’ve been steadily gaining momentum on our strategy in targeting brands, retailers, and their global fulfillers, all of whom will greatly benefit from Kornit’s sustainable on-demand digital solutions, instead of existing analog production. We had a strong quarter for Atlas MAX Poly, and continued to strengthen our market-leading position in direct-to-fabric (DTF) with Presto MAX. The progress made in the first quarter offers additional proof points that our MAX technology is becoming the industry standard and an excellent solution that offers top retail quality output, increased productivity, better cost efficiencies, and new product capabilities and offerings.”

Mr. Samuel concluded, “We are excited to attend the upcoming ITMA tradeshow in Milan, where we will demonstrate how digital production goes mainstream with sustainable on-demand manufacturing at scale. We will showcase a diverse range of new cutting-edge DTF and DTG solutions, including unveiling our highly anticipated Apollo, which will revolutionize markets traditionally served by analog. These new systems and solutions significantly extend the breadth of print applications and offer levels of automation never before seen in any of the markets we serve.”

First Quarter 2023 Results of Operations

Total revenue for the first quarter of 2023 was $47.8 million compared with $83.3 million in the prior year period, primarily due to expected lower systems revenues.

GAAP gross profit margin for the first quarter of 2023 was 27.4% compared with 40.1% in the prior year period. On a non-GAAP basis, gross profit margin was 30.2% compared with 41.5% in the prior year period.

GAAP operating expenses for the first quarter of 2023 decreased by 7.7% to $37.2 million compared with the prior year period. On a non-GAAP basis, operating expenses also decreased by 8.0% to $32.4 million compared with the prior year period.

GAAP net loss for the first quarter of 2023 was $18.9 million, or ($0.38) per basic share, compared with net loss of $5.2 million, or ($0.10) per basic share, for the first quarter of 2022.

Non-GAAP net loss for the first quarter of 2023 was $13.4 million, or ($0.27) per basic share, compared with non-GAAP net income of $0.2 million, or $0.00 per diluted share, for the first quarter of 2022.

Adjusted EBITDA loss for the first quarter of 2023 was $14.7 million compared with adjusted EBITDA of $1.5 million for the first quarter of 2022. Adjusted EBITDA margin for the first quarter of 2023 was -30.8% compared with 1.8% for the first quarter of 2022.

Second Quarter 2023 Guidance

For the second quarter of 2023, the Company expects revenues to be in the range of $54 million to $59 million and adjusted EBITDA margin between -19% to -27% of revenue. The guidance for revenue and adjusted EBITDA margin includes the impact of the non-cash expense associated with the fair value of the Company’s warrants.